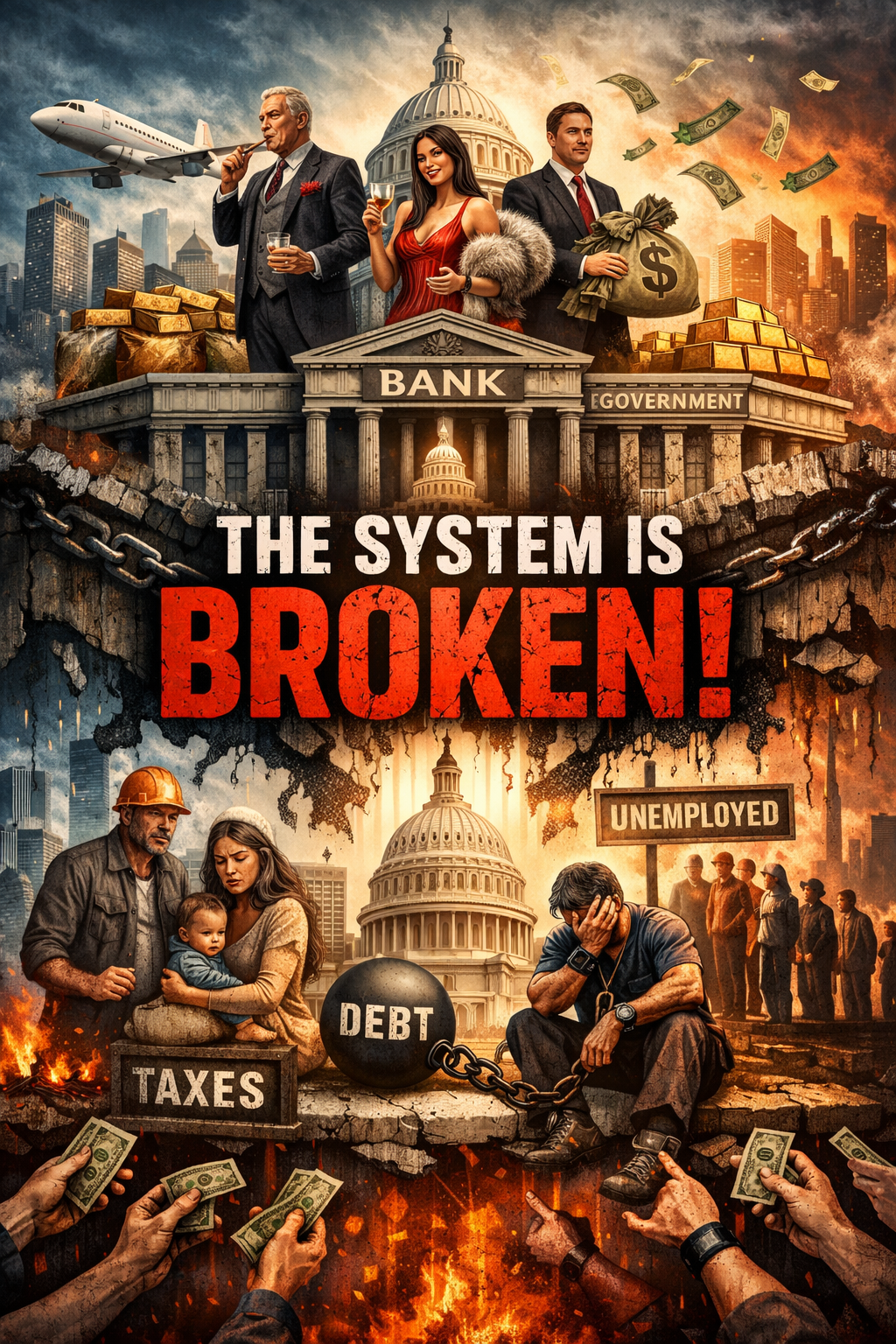

The System Is Broken: Why the Rich Get Richer While the Poor Struggle Harder

We are told we live in a fair economic system. Work hard. Study hard. Be disciplined. Save money. Pay taxes. Follow the law. And eventually, success will come.

But look carefully.

The richest are getting richer at historic speed. The middle class is shrinking. The working class is exhausted. Small businesses collapse while corporate giants expand. Governments talk about “fairness,” yet policies quietly protect those already at the top.

So what is really happening?

This is not an emotional rant. This is structural analysis.

1. The Illusion of Equal Opportunity

The system tells you:

- Anyone can make it.

- Markets reward merit.

- Success is earned purely by hard work.

But here is the uncomfortable truth:

We do not start from the same position.

Some inherit capital, connections, networks, insider knowledge, political influence, and asset ownership. Others inherit debt, weak schools, unstable jobs, and rising living costs.

When wealth compounds, it grows exponentially.

When wages stagnate, they barely survive inflation.

The rich don’t primarily work for money.

Their money works for them.

The poor and middle class exchange time for money.

The wealthy exchange assets for growth.

That is the structural divide.

2. Why the Rich Get Richer

A. Asset Inflation Favors Owners

Central banks print money during crises. Governments stimulate markets. Interest rates are manipulated. Quantitative easing injects liquidity.

Where does that money go first?

Into financial markets.

- Stocks rise.

- Property prices surge.

- Corporate valuations expand.

Who owns these assets?

Primarily the wealthy.

When asset prices inflate, those who own assets multiply their wealth — without working more hours.

Meanwhile, wages rarely rise at the same pace as asset inflation.

Result: inequality widens.

B. Bailouts Protect the Powerful

When large corporations fail, they are called “too big to fail.”

Governments step in. Banks receive rescue packages. Corporations receive emergency funding. Investors are shielded.

When small businesses fail?

They are told: “That’s the market.”

When individuals struggle?

They are told: “Work harder.”

The system socializes losses and privatizes profits.

C. Tax Structures Are Not What They Seem

Governments claim to tax the rich.

But in reality:

- Wealth is taxed less than labor.

- Capital gains rates are often lower than income tax.

- Large corporations use legal loopholes.

- Offshore structures legally minimize tax burden.

The working professional pays visible income tax.

The ultra-wealthy use structures, trusts, deductions, and asset-based leverage.

The system rewards ownership, not effort.

D. Debt Is the Hidden Engine

The system runs on debt.

Governments borrow.

Corporations borrow.

Individuals borrow.

Debt expands economic growth in the short term — but it creates dependency.

The average person is trapped in:

- Mortgage debt

- Student loans

- Credit card debt

- Car financing

Debt forces people to remain employed within the system.

Freedom decreases.

The wealthy, however, use debt strategically — to acquire more assets.

Debt for survival vs. debt for leverage.

Two completely different realities.

3. The Employment Myth

We are told:

“Get a good job. That is security.”

But job security has changed.

- Automation replaces workers.

- AI replaces middle management.

- Gig economy removes benefits.

- Contracts replace permanence.

Corporations reduce long-term obligations.

Workers absorb long-term uncertainty.

Employment is no longer stability — it is controlled dependency.

And yet mainstream media still promotes the old narrative.

Why?

Because questioning employment structures questions the entire economic design.

4. Media Narratives Hide Structural Truth

Mainstream discussions focus on:

- Inflation numbers

- Interest rate decisions

- GDP growth

- Stock market performance

But they rarely ask:

Who benefits from monetary policy?

Who writes financial regulation?

Who influences economic law?

Economic systems are not accidental.

They are designed through political influence and financial lobbying.

Power protects power.

5. The Psychological Conditioning

The system survives because of belief.

People believe:

- “This is the only system possible.”

- “If I fail, it’s my fault.”

- “Wealth equals moral superiority.”

- “If someone is rich, they must deserve it.”

Shame is individualized.

Structure is hidden.

This is powerful social control.

When individuals blame themselves, they don’t question design.

6. Is the Entire System Evil?

No.

Markets create innovation.

Capital allocates resources.

Businesses generate opportunity.

The problem is not markets themselves.

The problem is captured markets.

When policy, finance, and corporate power align without transparency, the system stops serving society and begins serving insiders.

Justice becomes rhetoric.

Truth becomes branding.

Fairness becomes marketing.

So What Is the Solution?

Anger is not a solution.

Collapse is not a solution.

Violence is not a solution.

Structural reform requires clarity and strategy.

Here are real solutions:

1. Shift From Wage Dependency to Asset Ownership

Individuals must:

- Invest early (even small amounts).

- Build digital assets.

- Create income streams beyond employment.

- Understand financial literacy deeply.

Ownership changes everything.

2. Encourage Local and Decentralized Economies

Communities can:

- Support local enterprise.

- Reduce dependency on corporate monopolies.

- Build cooperative models.

- Promote skill-based independence.

Economic power should not be centralized in a few institutions.

3. Reform Tax and Financial Policy

Governments must:

- Close legal tax loopholes.

- Equalize capital and labor taxation structures.

- Increase transparency in corporate lobbying.

- Reduce monetary policies that inflate assets without raising wages.

Justice requires structural correction, not slogans.

4. Redefine Success

Society must stop equating:

Wealth = virtue

Consumption = achievement

Status = identity

Success should include:

- Contribution

- Skill

- Integrity

- Stability

- Community strength

5. Financial Education Must Be Mandatory

Most people graduate without understanding:

- How money is created.

- How inflation works.

- How debt compounds.

- How asset leverage functions.

An uninformed population is easily controlled.

An informed population negotiates power.

Final Thought

The system is not collapsing — it is concentrating.

It rewards those who understand its rules.

It drains those who do not.

Justice cannot exist where structural advantage is hidden.

Truth cannot survive where narrative replaces transparency.

The question is not whether the system is broken.

The question is whether we are willing to see it clearly — and build something better.